Cyprus company formation. To form a company in Cyprus, you will need to provide certain documents and information. Here are the typical requirements for Cyprus company formation: 1. Shareholders: You need at least one shareholder to form a company...

There are two options when you want to open a bank account for your Cyprus company. Opening a bank account with a commercial bank and Opening a bank account with an electronic money institution. The information relates to the opening of bank...

A company is a legal person. As such it has what is called “perpetual succession”. In other words it never dies. The question offers arises how a company can be dissolved or be “killed”. In most common law jurisdictions there two methods: One is...

Cyprus Offshore Company, the term recently substituted by Cyprus International Business Company, is a separate legal entity. The most commonly used form is private Limited Liability Company. Under this framework, there are many sub structures in...

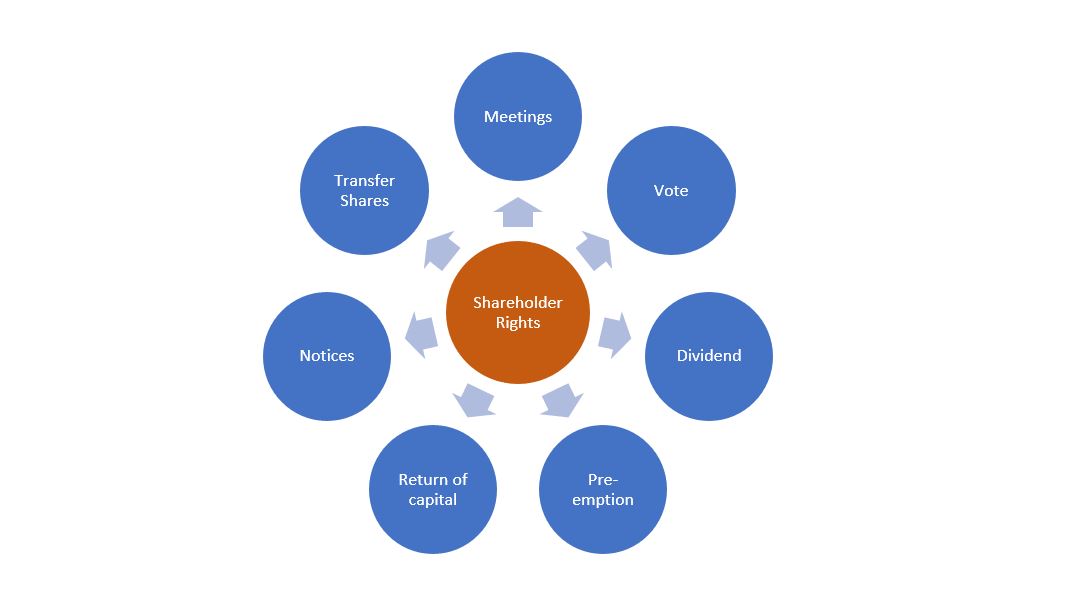

Many times I get asked the question, usually from minority shareholders, what are my rights as a shareholder? There is a simple answer and a more complicated one. In this article I will list the basic rights of a shareholder, usually referred to as...

Become a Cyprus Tax Resident in Just 60 Days Did you know you can become a Cyprus tax resident by spending just 60 days a year in the country? Thanks to a law passed in July 2017, individuals who meet certain conditions can now enjoy tax residency...